The Financial Journal is a blog for all financial industry professionals. This blog has been, and always will be, interactive, intellectually stimulating, and open platform for all readers.

AdSense

Thursday, June 30, 2016

Wednesday, June 29, 2016

THE 50 GREATEST JAZZ ALBUMS…EVER

At the end of any year it’s a great time to look back and so we’ve decided to attempt to come up with a definitive list of the 50 Greatest Jazz Albums of all time. Impossible, you are probably thinking, and it probably is, but rather than just thinking of our favourites we decided to take a good look through the web to see what other lists there are and combine our findings.

As usual we expect many of you to disagree, sometimes strongly, but as usual we will love hearing from you.

It took us several days of searching but here it is, the 50 greatest…

50. Thelonious Monk – Genius of Modern Music vol.1 & 2.*

49. Count Basie – the Original American Decca Recordings*

48. Bud Powell – The Amazing Bud Powell Vo.1

47. Weather Report – Heavy Weather

46. John Coltrane & Thelonious Monk – At Carnegie Hall*

45. Horace Silver – Song For My Father

44. Grant Green – Idle Moments*

43. Count Basie – The Complete Atomic Basie*

42. Hank Mobley – Soul Station*

41. Charlie Christian – The Genius of the Electric Guitar*

40. Art Pepper meets the Rhythm Section

39. John Coltrane – My Favourite Things

38. Benny Goodman – At Carnegie Hall 1938

37. Wes Montgomery – The incredible Jazz Guitar of Wes Montgomery

36. The Mahavishnu Orchestra With John McLaughlin – Inner Mounting Flame*

35. Clifford Brown and Max Roach – Clifford Brown & Max Roach

34. Andrew Hill – Point of Departure*

33. Herbie Hancock – Head Hunters

32. Dexter Gordon – Go

31. Sarah Vaughan – With Clifford Brown

30. The Quintet – Jazz at Massey Hall

29. Bill Evans Trio – Waltz For Debby

28. Lee Morgan – The Sidewinder

27. Bill Evans – Sunday at the village Vanguard

26. Thelonious Monk – Brilliant Corners

25. Keith Jarrett – the Koln Concert

24. John Coltrane – Giant Steps

23. Herbie Hancock – Maiden Voyage

22. Duke Ellington – Ellington at Newport

21. Cecil Taylor – Unit Structures

20. Charlie Parker – Complete Savoy and Dial Studio recordings*

19. Miles Davis – Birth of the Cool

18. Art Blakey & the Jazz Messengers – Moaning’

17. Albert Ayler – Spiritual Unity*

16. Eric Dolphy – Out To Lunch

15. Oliver Nelson – The Blues and the Abstract Truth

14. Erroll Garner – Concert By the Sea*

13. Wayne Shorter – Speak No Evil

12. Stan Getz & Joao Gilberto – Getz/Gilberto

11. Louis Armstrong – Best of the Hot 5s and 7s*

10. John Coltrane – Blue Train

9. Miles Davis – Bitches Brew

8. Sonny Rollins – Saxophone Colossus

7. Cannonball Adderley – Somethin’ Else

6. Charles Mingus – The Black Saint and the Sinner Lady*

5. Ornette Coleman – The Shape of Jazz to Come

4. Charles Mingus – Mingus Ah Um*

3. Dave Brubeck Quartet – Time Out

2. John Coltrane – A Love Supreme

1. Miles Davis – Kind of Blue

* Not in my personal iTunes library

source:

http://www.udiscovermusic.com/50-greatest-jazz-albums-ever

As usual we expect many of you to disagree, sometimes strongly, but as usual we will love hearing from you.

It took us several days of searching but here it is, the 50 greatest…

50. Thelonious Monk – Genius of Modern Music vol.1 & 2.*

49. Count Basie – the Original American Decca Recordings*

48. Bud Powell – The Amazing Bud Powell Vo.1

47. Weather Report – Heavy Weather

46. John Coltrane & Thelonious Monk – At Carnegie Hall*

45. Horace Silver – Song For My Father

44. Grant Green – Idle Moments*

43. Count Basie – The Complete Atomic Basie*

42. Hank Mobley – Soul Station*

41. Charlie Christian – The Genius of the Electric Guitar*

40. Art Pepper meets the Rhythm Section

39. John Coltrane – My Favourite Things

38. Benny Goodman – At Carnegie Hall 1938

37. Wes Montgomery – The incredible Jazz Guitar of Wes Montgomery

36. The Mahavishnu Orchestra With John McLaughlin – Inner Mounting Flame*

35. Clifford Brown and Max Roach – Clifford Brown & Max Roach

34. Andrew Hill – Point of Departure*

33. Herbie Hancock – Head Hunters

32. Dexter Gordon – Go

31. Sarah Vaughan – With Clifford Brown

30. The Quintet – Jazz at Massey Hall

29. Bill Evans Trio – Waltz For Debby

28. Lee Morgan – The Sidewinder

27. Bill Evans – Sunday at the village Vanguard

26. Thelonious Monk – Brilliant Corners

25. Keith Jarrett – the Koln Concert

24. John Coltrane – Giant Steps

23. Herbie Hancock – Maiden Voyage

22. Duke Ellington – Ellington at Newport

21. Cecil Taylor – Unit Structures

20. Charlie Parker – Complete Savoy and Dial Studio recordings*

19. Miles Davis – Birth of the Cool

18. Art Blakey & the Jazz Messengers – Moaning’

17. Albert Ayler – Spiritual Unity*

16. Eric Dolphy – Out To Lunch

15. Oliver Nelson – The Blues and the Abstract Truth

14. Erroll Garner – Concert By the Sea*

13. Wayne Shorter – Speak No Evil

12. Stan Getz & Joao Gilberto – Getz/Gilberto

11. Louis Armstrong – Best of the Hot 5s and 7s*

10. John Coltrane – Blue Train

9. Miles Davis – Bitches Brew

8. Sonny Rollins – Saxophone Colossus

7. Cannonball Adderley – Somethin’ Else

6. Charles Mingus – The Black Saint and the Sinner Lady*

5. Ornette Coleman – The Shape of Jazz to Come

4. Charles Mingus – Mingus Ah Um*

3. Dave Brubeck Quartet – Time Out

2. John Coltrane – A Love Supreme

1. Miles Davis – Kind of Blue

* Not in my personal iTunes library

source:

http://www.udiscovermusic.com/50-greatest-jazz-albums-ever

THE 50 GREATEST JAZZ PIANISTS

Scroll down for their playlist of the 36 Greatest Jazz Pianists…

But why 36? Well as we all know there are 36 black keys on a piano…

36. Andrew Hill

35. Dave Grusin

34. Cecil Taylor

33. Lyle Mays

32. Sonny Clark

31. Michel Petucciani

30. Hank Jones

29. Scott Joplin

28. Ramsey Lewis

27. Wynton Kelly

26. James P. Johnson

25. Kenny Kirkland

24. Bob James

23. George Shearing

22. Joe Zawinul

21. Teddy Wilson

20. Horace Silver

19. Red Garland

18. Tommy Flanagan

17. Erroll Garner

16. Dave Brubeck

15. Jelly Roll Morton

14. Earl Hines

13. Count Basie

12. Fats Waller

11. Duke Ellington

10. Ahmed Jamal

9. Chick Corea

8. Keith Jarrett

7. Bud Powell

6. McCoy Tyner

5. Oscar Peterson

4. Herbie Hancock

3. Bill Evans

2. Thelonious Monk

1. Art Tatum

Source:

http://www.udiscovermusic.com/greatest-jazz-pianists

But why 36? Well as we all know there are 36 black keys on a piano…

36. Andrew Hill

35. Dave Grusin

34. Cecil Taylor

33. Lyle Mays

32. Sonny Clark

31. Michel Petucciani

30. Hank Jones

29. Scott Joplin

28. Ramsey Lewis

27. Wynton Kelly

26. James P. Johnson

25. Kenny Kirkland

24. Bob James

23. George Shearing

22. Joe Zawinul

21. Teddy Wilson

20. Horace Silver

19. Red Garland

18. Tommy Flanagan

17. Erroll Garner

16. Dave Brubeck

15. Jelly Roll Morton

14. Earl Hines

13. Count Basie

12. Fats Waller

11. Duke Ellington

10. Ahmed Jamal

9. Chick Corea

8. Keith Jarrett

7. Bud Powell

6. McCoy Tyner

5. Oscar Peterson

4. Herbie Hancock

3. Bill Evans

2. Thelonious Monk

1. Art Tatum

Source:

http://www.udiscovermusic.com/greatest-jazz-pianists

Friday, June 24, 2016

The Goal: A Process of Ongoing Improvement by Eliyahu M. Goldratt, Jeff Cox

This is a great book that explains the Theory Of Constraints (TOC) for supply chain and production management.

"The Goal" of a company is making a profit.

For a factory, key performance indicators from an accounting perspective are (1) net income, (2) profitability = (net income) / (capital invested), and (3) cash flows. This book explains that indicators are (a) throughput: cash inflow generated by sales, not production, (b) inventory: capital invested for products/services to generate cash flows, and (c) operating expenses: cash outflows, expenses to turn inventories into throughput.

Also, the cash used and saleable is (b) inventory while the cash used but unsaleable is (c) throughput. You can explain everything in your factory by using cash.

A well-balanced factory produces products by using resources in a timely manner; that is, supply and demand from their customers are perfectly matched. However, this type of factory is vulnerable; say, if you reduce your (a) throughput based on decreased demand, then (b) inventory gets bigger and (c) operating expenses get higher. This is mathematically proved, although the proof is omitted here. This is due to both statistical fluctuations and dependent events. Every process is connected with each other, so if you would like to optimise your entire process at your factory, you can have redundant resources because there is statistical fluctuations.

TOC / five focusing steps:

The Goal: A Process of Ongoing Improvement by Eliyahu M. Goldratt, Jeff Cox

amazon.com

amazon.co.jp

"The Goal" of a company is making a profit.

For a factory, key performance indicators from an accounting perspective are (1) net income, (2) profitability = (net income) / (capital invested), and (3) cash flows. This book explains that indicators are (a) throughput: cash inflow generated by sales, not production, (b) inventory: capital invested for products/services to generate cash flows, and (c) operating expenses: cash outflows, expenses to turn inventories into throughput.

Also, the cash used and saleable is (b) inventory while the cash used but unsaleable is (c) throughput. You can explain everything in your factory by using cash.

A well-balanced factory produces products by using resources in a timely manner; that is, supply and demand from their customers are perfectly matched. However, this type of factory is vulnerable; say, if you reduce your (a) throughput based on decreased demand, then (b) inventory gets bigger and (c) operating expenses get higher. This is mathematically proved, although the proof is omitted here. This is due to both statistical fluctuations and dependent events. Every process is connected with each other, so if you would like to optimise your entire process at your factory, you can have redundant resources because there is statistical fluctuations.

TOC / five focusing steps:

- Finding a constraint

- Decide how to optimise the constraint

- Change every process based on the optimisation in step 2

- Improve an ability limited by the constraint

- If you can fix the problem of the constraint, then go back to step 1

The Goal: A Process of Ongoing Improvement by Eliyahu M. Goldratt, Jeff Cox

amazon.com

amazon.co.jp

Monday, June 20, 2016

The Presentation Secrets of Steve Jobs: How to Be Insanely Great in Front of Any Audience / Carmine Gallo

The Presentation Secrets of Steve Jobs: How to Be Insanely Great in Front of Any Audience

Carmine Gallo

The Presentation Secrets of Steve Jobs: How to Be Insanely Great in Front of Any Audience

The Presentation Secrets of Steve Jobs: How to Be Insanely Great in Front of Any Audience

Two Sigma

Two Sigma builds trading algorithms around four kinds of information:

1. Technical information (e.g., trading volumes of stocks)

2. Event-based information (e.g., credit agency actions, mergers or other news)

3. Fundamental data (e.g., corporate financial statements)

4. Alpha capture (company- or industry-specific intelligence, not publicly available per se and gathered via proprietary surveys)

David Siegel (cofounder)

"You have to formulate your big-data analysis in a way that you can understand whether or not you are over-fitting the data or actually extracting legitimate information out of the data--that is what the business is all about."

Source: Forbes

Thursday, June 16, 2016

Smartphone addiction

When a train arrived, a woman behind me in the line pushed and passed me, and kept her seat while staring at her smartphone. It is like drag and alcohol addiction. People like her need doctors and therapists' help to fix her/his problem. They are vulnerable to stimulation and temptation from smartphones. They have no sense of self-discipline.

Thursday, June 9, 2016

Japanese at train stations and/or on trains in Tokyo

Japanese at train stations and/or on trains in Tokyo:

1. Rushing into their trains (and sometime s bump into you)

2. Cling to others to fill in the space (I'm sure you feel uncomfortable.)

3. Staring at their smartphones (even while walking)

4. Drunk and noisy (especially late at night, because they always have to be quiet and stay sober during the day and it is stressful to them?)

The Intelligent Investor, Rev. Ed Kindle Edition by Benjamin Graham,Jason Zweig, Warren E. Buffett (Collaborator)

Ben Graham is considered to be a father of value investing and a teacher of Warren Buffett.

"Great investors have objectivity, simplicity, and passion."

"Great companies to invest are like castles surrounded by a moat, which includes brand, low cost operation, near-monopoly status, and impressive services."

"No matter which techniques they use in picking stocks, successful investing professionals have two things in common: First, they are disciplined and consistent, refusing to change their approach even when it is unfashionable. Second, they think a great deal about what they do and how to do it, but they pay very little attention to what the market is doing."

"As Graham liked to say, in the short run the market is a voting machine, but in the long run it is a weighing machine."

"When you buy a stock, you become an owner of the company."

"Great investors have objectivity, simplicity, and passion."

"Great companies to invest are like castles surrounded by a moat, which includes brand, low cost operation, near-monopoly status, and impressive services."

"No matter which techniques they use in picking stocks, successful investing professionals have two things in common: First, they are disciplined and consistent, refusing to change their approach even when it is unfashionable. Second, they think a great deal about what they do and how to do it, but they pay very little attention to what the market is doing."

"As Graham liked to say, in the short run the market is a voting machine, but in the long run it is a weighing machine."

"When you buy a stock, you become an owner of the company."

"The first and most obvious of these principles is, "Know what you're doing--know your business.""

"A second business principle: "Do not let anyone else run your own business, unless (1) you can supervise his performance with adequate care and comprehension or (2) you have unusually strong reasons for placing implicit confidence in his integrity and ability.""

"A third business principle: "Do not enter upon an operation--that is, manufacturing or trading in an item--unless a reliable calculation shows that it has a fair chance to yield a reasonable profit. In particular, keep away from ventures in which you have little to gain and much to lose."

A fourth business rule is more positive: "Have the courage of your knowledge and experience. If you have formed a conclusion from the facts and if you know your judgement is sound, act on it--even though others may hesitate or differ."

The Intelligent Investor, Rev. Ed Kindle Edition

by Benjamin Graham, Jason Zweig, Warren E. Buffett (Collaborator)

amazon.com

amazon.co.jp

The Intelligent Investor, Rev. Ed Kindle Edition

by Benjamin Graham, Jason Zweig, Warren E. Buffett (Collaborator)

amazon.com

amazon.co.jp

Wednesday, June 8, 2016

The Black Swan / Nassim Nicholas Taleb

Features of the "black swan":

amazon.com

amazon.co.jp

1. Abnormal (outside of our imagination)

2. Huge impact

3. Two types.

Type I: After it happened, we tend to think it predictable by using reasons that sound like a truth (but actually aren't). Probabilties / impacts of this type are overestimated.

Type II: We cannot include this type into our model, so it tends to be ignored. Probabilties / impacts of this type are underestimated.

We have to distinguish two things:

[A] There is no evidence that a "black swan" exists.

[B] There is an evidence that a "black swan" does not exist.

You can keep betting on a black swan, if you want. However, people tend to prefer small and short-term continuous profits to big ones that might not get realized in the long run.

Consider biases (e.g., survivorship bias - You can't know what underdogs did/thought.) and distortion (e.g., skewness, kurtosis, over- and under-estimation, estimates vs realities).

You must imagine what you cannot see or recall. People do not recognize what they cannot see and something don't promote their emotional interests.

Do right things at a rough estimate and/or hypothesis, don't do wrong things in a precise manner.

The Black Swan: Second Edition: The Impact of the Highly Improbable Fragility" (Incerto) Kindle Edition by Nassim Nicholas TalebDo right things at a rough estimate and/or hypothesis, don't do wrong things in a precise manner.

amazon.com

amazon.co.jp

Subscribe to:

Comments (Atom)

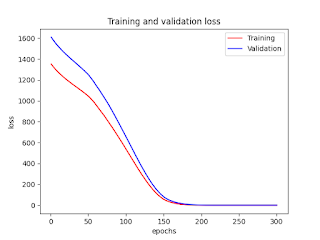

Deep Learning (Regression, Multiple Features/Explanatory Variables, Supervised Learning): Impelementation and Showing Biases and Weights

Deep Learning (Regression, Multiple Features/Explanatory Variables, Supervised Learning): Impelementation and Showing Biases and Weights ...

-

This is a great paper to understand having and applying principles to day-to-day business and personal lives. If you do not have your own ...

-

Black-Litterman Portfolio Optimization with Python This is a very basic introduction of the Black-Litterman portfolio optimization with t...

-

0_MacOS_Python_setup_for_Quandl.txt # Go to: https://www.quandl.com/ # Sign up / in with your email address and password # Run Termina...