My own summary:

Ordinary people care about risk (exposure) and reward. Philosophers, theorists, and pure researchers argue, decide whether a thing is right or wrong, and equate truth with risk and reward.

Most importantly, a payoff is more important than philosopers' belief (right or wrong). Furthermore, there is a positive skew (asymmetry) / anti-fragility and negative skew (fragility).

People are correctly making a decision based on fragility, not probability.

When things go efficient, they become fragile.

Academics and experts of quantitative analysis are those who disrespect what they can easily understand and get upset about ideas that they cannot come up with.

Your success in investments is not because of your accurate forecasts; it is thanks to asymmetric payoffs and optionality.

When your payoff is liner, then you have to make right decisions more than 50% of the time.

If a payoff is nonlinear and anti-fragile, then this probability could be less than that.

What people think right now could turn out to be right or wrong; what people believe wrong could barely be right.

A disproof is more strict (robust) than a proof.

Volatility and disorder could be profits for antifragile things thanks to asymmetric payoff distributions.

Ignore what they say, see how they act; that’s the best way to distinguish practitioners from chatterers.

The Financial Journal is a blog for all financial industry professionals. This blog has been, and always will be, interactive, intellectually stimulating, and open platform for all readers.

AdSense

Subscribe to:

Post Comments (Atom)

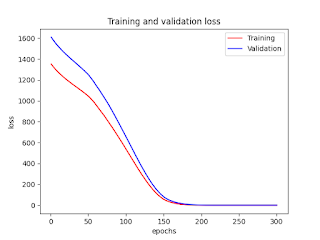

Deep Learning (Regression, Multiple Features/Explanatory Variables, Supervised Learning): Impelementation and Showing Biases and Weights

Deep Learning (Regression, Multiple Features/Explanatory Variables, Supervised Learning): Impelementation and Showing Biases and Weights ...

-

This is a great paper to understand having and applying principles to day-to-day business and personal lives. If you do not have your own ...

-

Black-Litterman Portfolio Optimization with Python This is a very basic introduction of the Black-Litterman portfolio optimization with t...

-

0_MacOS_Python_setup_for_Quandl.txt # Go to: https://www.quandl.com/ # Sign up / in with your email address and password # Run Termina...

No comments:

Post a Comment